In 2017, an overwhelming 71% of DeKalb County voters approved the county’s first Special Option Local Sales Tax (SPLOST), adding a penny sales tax to fund public safety and capital improvements. The penny tax has is expected to generate $636 million for the county and its cities by the time it expires in 2024.

Those funds have allowed hundreds of miles of roads to be repaired, helped modernize public safety and fire-rescue operations, and underwritten vital infrastructure needs.

On Nov. 7, 2023, county voters will once again be asked to approve “Pennies for DeKalb.” If what’s known as SPLOST II is approved by voters, this time there’ll be a difference in how the funds can be spent. Thanks to a recent move by Georgia lawmakers, the funds may be allocated for more kinds of projects.

“The DeKalb Board of Commissioners, CEO Michael Thurmond and departmental leaders want to make sure voters know about the referendum and what it means for the county going forward, so they can make an informed decision in November,” said County Commission Presiding Officer and District 1 Commissioner Robert Patrick.

In one of an ongoing series of informational public meetings, CEO Thurmond noted that DeKalb’s SPLOST I was the only one in the state required by the General Assembly to allocate 85% of all proceeds to transportation and public safety spending with the remaining 15% targeted to capital outlay projects.

SPLOST I funded many DeKalb County needs, including the resurfacing of more than 250 miles of roads, the construction of a new fire station and a new modern fire-rescue academy.

Thurmond added that this year’s legislation provides voters with an opportunity to approve an “adult SPLOST” allowing county leaders more flexibility in working with department heads to allocate funds where they’re most needed.

“Your pennies are working,” said Thurmond, noting that SPLOST I garnered the support of all 12 mayors of DeKalb County’s cities, a remarkable show of unanimity across party and demographic lines.

Thurmond also pointed out that – unlike other Georgia counties – DeKalb does not tax prepared food or prescription drugs, which he terms “regressive” taxes that disproportionately burden poor and elderly citizens.

How DeKalb County taxes are distributed

Beginning in April 2018, DeKalb County’s effective sales tax on goods purchased in DeKalb – excluding areas of Atlanta in DeKalb – was 8%. Of that, 4% goes to the state of Georgia; 1% goes to fund MARTA; 1% is for E-SPLOST, the educational fund for DeKalb, Decatur and Atlanta Independent School systems; 1% is known as EHOST and is used to provide property tax relief; and 1% goes to the county SPLOST.

In addition to public safety funding, SPLOST I funds have been used to resurface more than 300 county streets, fill potholes, add 10 new paramedic positions, and update the DeKalb County Police vehicle fleet and evidence room. It’s also allowed for repairs and improvements to county parks, libraries and senior centers.

This years SPLOST II will include 17 categories that the Administration has recommended. In order to get your feedback, I will be hosting a SPLOST II Community Meeting.

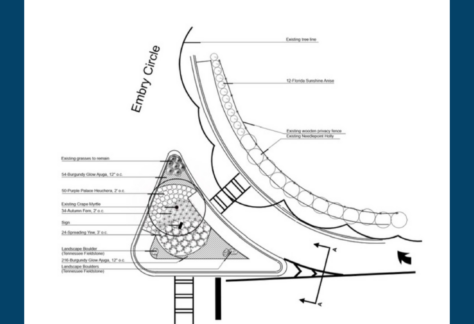

On Thursday, August 17th ,I invite you to attend my SPLOST II Community Meeting. The meeting will take place at the Embry Hills Library from 7:00 p.m. to 8:00p.m. Joining me at the meeting will be key representatives from the CEO’s office, our legal department, budget office, and our Atlas program management office.

If you cannot attend in-person, other ways to participate include:

- Virtual location for the above meeting: https://dekalbcountyga.zoom.us/j/87023917274 Password: 369678

- Complete the District 1 SPLOST Survey: https://bit.ly/District1_SPLOST_Survey